Direct tax and indirect tax Upsc

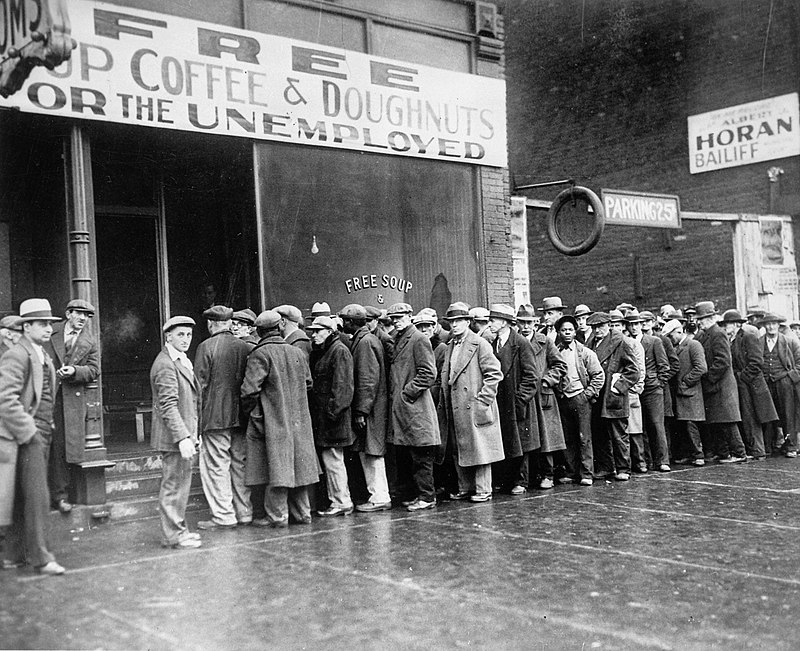

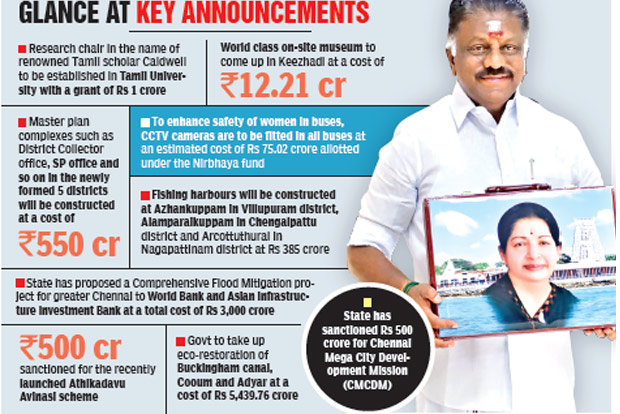

Examples for direct tax and indirect tax Direct Tax A direct tax is a tax that is levied on a person’s income or wealth. It is paid directly to the government. The burden of Direct tax cannot be shifted. The tax is progressive and is levied according to the paying capacity of the person. Here … Read more